You’ve got SOL sitting in your wallet. Maybe it’s staked, maybe it’s idle. Either way, you’re probably asking:

How can I earn more without taking on wild risks?

That’s where Sharky comes in—an easy way to earn high APY by offering short-term loans to NFT holders who need instant liquidity.

No pools. No lockups. No guesswork. Just you, your SOL, and a simple, smart contract-secured system where borrowers use NFTs as collateral—and you earn yield.

If the borrower repays, you earn interest. If they default, you keep the NFT. It’s fast, transparent, and built for lenders who want high returns and real control.

How Sharky Works

Sharky is a peer-to-peer lending platform on Solana. Instead of staking your SOL for 6–8% APY, Sharky lets you offer short-term loans directly to NFT holders—often with 100–200%+ annualized returns.

Let’s walk through an example:

You: The Lender

You’re browsing the Sharky orderbook and see DeGods, a well-known Solana collection with strong demand.

- Floor price: 8.6 SOL

- You offer: 8.15 SOL

- Duration: 7 days

- APY: 180%

- Expected interest: ~0.16 SOL

The Borrower

A DeGods holder needs quick SOL—maybe for a mint or a trade. They accept your offer and use their NFT as collateral. You instantly send them 8.15 SOL.

The Contract

A smart contract handles everything. You receive a promissory note, and the borrower’s NFT is locked in their wallet—they can’t transfer it, but they still keep access (for DAO votes, airdrops, etc.).

After 7 Days

- If repaid: You get back 8.15 SOL + 0.16 SOL interest.

- If defaulted: You receive the DeGods NFT—now yours to hold or sell.

This structure gives you two ways to win: interest from repayment, or acquiring an NFT at a discount.

Lender Strategy

Sharky puts you in the driver’s seat—but smart strategy makes all the difference.

1. Pick Strong Collections

Start with trusted, high-liquidity collections like DeGods, SMB, Mad Lads, Claynosaurz, or Famous Fox Federation. These projects tend to attract more reliable borrowers and hold value better if you receive the NFT.

Check real-time collection stats on:

- Tensor – Real-time floor prices and Sharky integration

- Magic Eden – Floor prices, listings, and market sentiment

- Hyperspace – Aggregates listings across marketplaces

- SolanaFloor – Rankings, historical data, and liquidity

2. Understand LTV (Loan-to-Value)

If the floor is 8.6 SOL and you offer 8.15, your LTV is ~95%. That’s high—and riskier. Many lenders choose to over-collateralize, offering 80–90% of floor value to reduce exposure.

Ask yourself: Would I be okay owning this NFT if the borrower defaults?

3. Monitor Floor Prices

NFT markets move fast. If a floor drops, your loan might be “underwater”—the NFT is now worth less than your loan amount.

If a floor rises, however, and the borrower defaults, you might end up with a more valuable NFT.

4. Don’t Chase APY Blindly

180–300% APY sounds great—but the higher the APY, the higher the risk of default. Stay focused on quality collections and sustainable offers rather than just chasing yield.

How to Lend Using Sharky

Now that you’ve got your strategy, here’s how to place your first loan offer.

Step 1: Visit the Orderbook

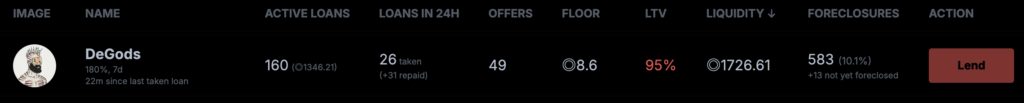

Head to sharky.fi and browse the collections. You’ll see each project’s:

This is Sharky’s orderbook, where you can view real-time lending activity. Think of it like a leaderboard for lending opportunities—sorted by performance, liquidity, and risk.

You’ll see the current loan terms listed under the name—180% APY over 7 days—along with how recently a loan was taken (just 2 hours ago). That tells you borrowers are active.

There are 160 active loans, meaning plenty of people are already using DeGods for borrowing. 25 loans were taken in the last 24 hours, and 31 were repaid, showing strong repayment behavior. There are 41 loan offers currently available, so you’ll need to be competitive if you want your offer accepted.

The floor price is 8.6 SOL, and the average LTV (loan-to-value) is 95%. That means lenders are offering about 8.2 SOL per loan—pretty close to the NFT’s market value, which can be risky. The liquidity pool here is deep, with over 1,600 SOL in total offers, and foreclosures sit at 10.1%, meaning roughly 1 in 10 borrowers default.

This gives you a full picture of what’s happening across the market—and helps you decide where your SOL will be most effective.

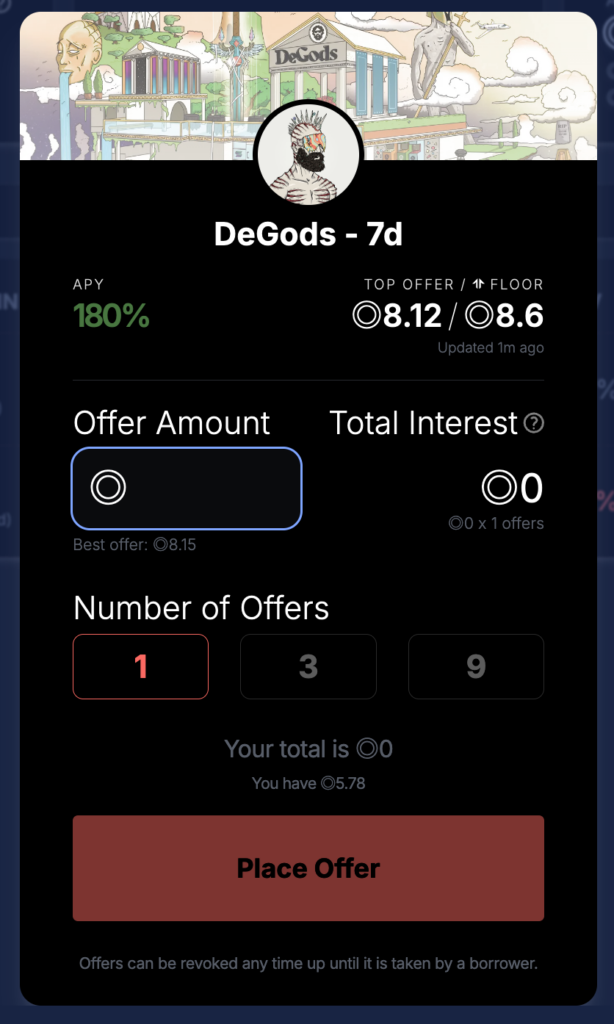

After clicking “Lend” on a collection like DeGods, you’ll be taken to this offer screen. This is where you set the actual terms of your loan offer.

Step 2: Click “Lend” and Place Your Offer

After selecting a collection (e.g. DeGods), click “Lend” to open the offer screen.

Here’s what you do:

- Enter the loan amount (in SOL) you want to offer per NFT. For example, if you type in 8.2 SOL, you’re offering that amount to a borrower in exchange for 180% APY over 7 days.

- A small note below shows the current best offer—helpful to decide if you want to beat it or play it safe.

- A small note below shows the current best offer—helpful to decide if you want to beat it or play it safe.

- Choose the number of offers you want to place at that amount. You can select 1, 3, or 9 offers. Each offer is for one NFT loan, so if you select 3, you’re offering loans for up to 3 different DeGods NFTs.

- As you adjust these fields, the Total Interest and Total SOL required will update automatically. This helps you see exactly what you’re committing.

Once you’re ready, click Place Offer. Confirm transaction with your wallet and your offer is now live on the Sharky orderbook. Borrowers can see it instantly—and if one accepts, the smart contract will automatically execute the loan.

You can revoke your offer anytime—unless a borrower accepts it.

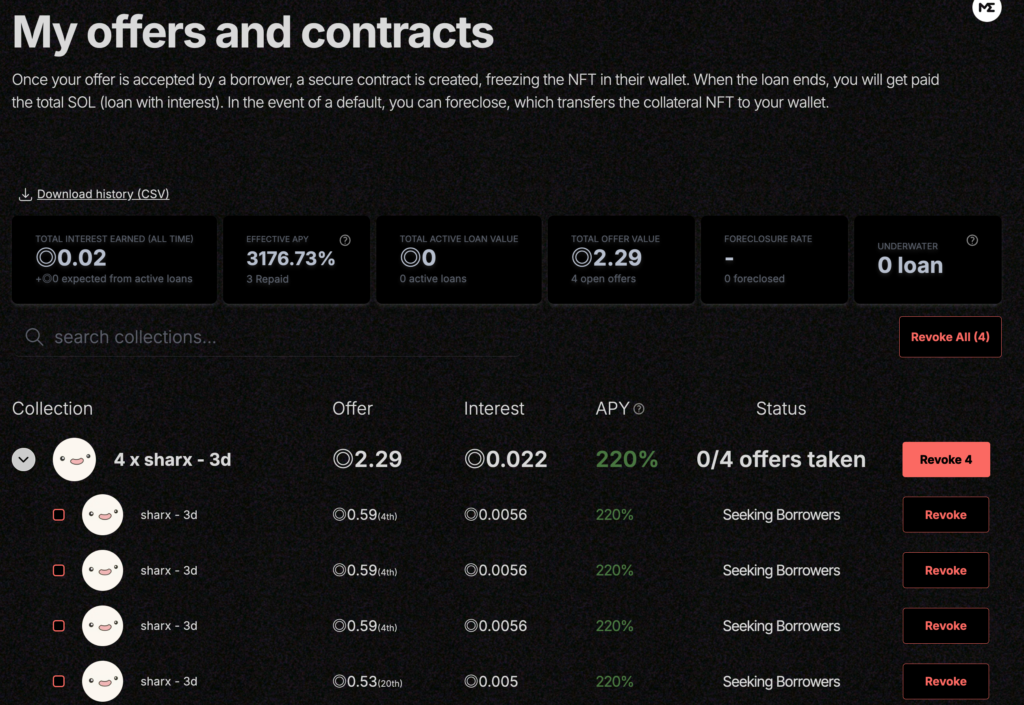

Once your offers are live, visit your dashboard at sharky.fi/offers to monitor everything.

This is your personal control center on Sharky. It shows every loan offer you’ve placed, any active contracts, past repayments, and your earnings.

Right at the top, you get a quick performance snapshot:

- Total Interest Earned: How much you’ve made so far in interest (in SOL).

- Effective APY: The actual annualized return based on repaid loans— this also shows a very juicy 3176% because of short-term, high-yield loans.

- Total Active Loan Value: How much SOL is currently locked in active loans.

- Total Offer Value: SOL currently offered and waiting to be accepted.

- Foreclosure Rate: Shows how many of your loans ended in default (0 in this case—nice!).

- Underwater: Loans where the NFT value dropped below your offer—none here, which means your risk is well-managed.

Each row here shows one or more loan offers I have placed for a specific NFT collection. In this case, you’ve made 4 offers on “sharx” NFTs with a 3-day loan term.

Let’s break it down:

- Offer: Shows how much SOL you’re offering per loan. Each is around 0.53–0.59 SOL.

- Interest: This is what you’ll earn if your loan is accepted and repaid. Each one earns around 0.0056 SOL in 3 days.

- APY: The annualized return for that offer. You’ve set a 220% APY, which is quite high for such short durations.

- Status: “Seeking Borrowers” means your offers are live and waiting to be accepted. None have been taken yet (0/4 offers taken), but they’re visible on the public orderbook.

You can revoke any offer at any time—as long as a borrower hasn’t accepted it yet.

Sharky makes lending on Solana simple, fast, and rewarding. With clear visibility into collections it’s easy to spot opportunities and make smart moves.

Whether loans are repaid with interest or end in NFT foreclosures, the system is designed to keep lenders protected while offering strong upside. You choose how much to lend, when to lend, and which projects you believe in.

If you’re looking to earn high APY and stay active in the Solana ecosystem, Sharky is great for exactly that.

Sharky links: https://linktr.ee/sharkyfi